It will really be a little much less because you'll pay the principal down over the year, yet that's close adequate to illustrate this example. With this payment method, you can guarantee your mortgage is fully paid off at the end of the home loan duration. Some lenders might likewise let you get a mortgage on their SVR. Your loan provider decides the rate and might determine to enhance or reduce it over the period of your home mortgage. Allow to Purchase home mortgages are developed for home owners that want to let out their current home to renters as well as purchase a new home to stay in.

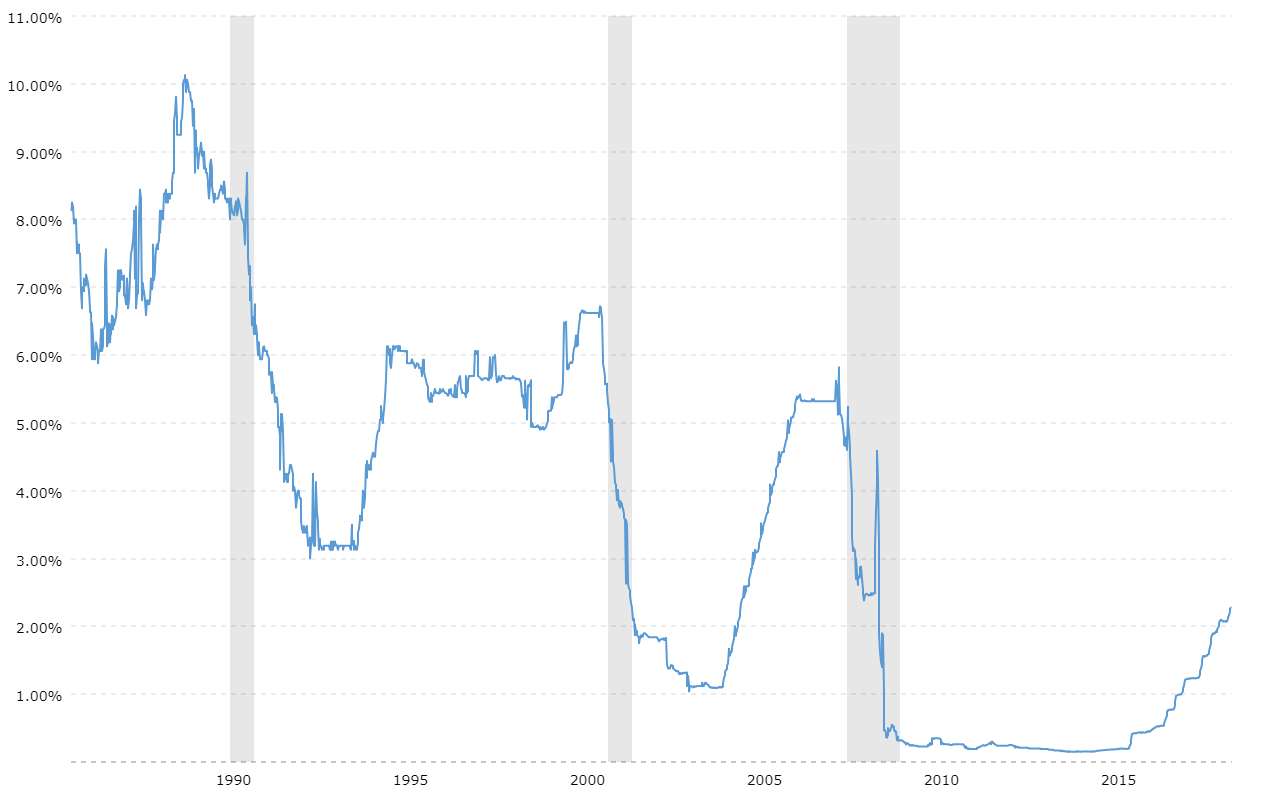

Some variable rates have a 'collar'-- a price below which they can't fall-- or are capped at a price that they can't exceed. See to it to watch out for these features when choosing your offer to ensure you recognize what you're signing up to. With a tracker mortgage, your rate of interest 'tracks' the Bank of England base rate (presently 0.1%)-- as an example, you may pay the base price plus 3% (3.1%). Bankrate's editorial group creates in support of YOU-- the reader. Our goal is to provide you the best advice to help you make clever individual finance decisions.

Some USDA fundings do not call for a deposit for qualified debtors with low earnings. There are additional fees, however, consisting of an upfront cost of 1 percent of the finance quantity as well as a yearly charge. If you have a solid credit report as well as can manage to make a substantial down payment, a conventional home loan is possibly your finest pick. The 30-year, fixed-rate standard home loan is one of the most popular selection for buyers.

The cost for this adaptability is generally a higher rates of interest. There are various types of versatile mortgage-- a countered mortgage is one. Such a home mortgage includes a home mortgage formed by the combination of 2 or even more types of home loans, as clarified over. The mortgagee, consequently, is entitled to take instant belongings of the building.

The debtor needs to settle the home loan money on the due date. To suitable such leas and profits instead of passion, or repayment of the mortgage cash, or partially in payment of the mortgage cash. The mortgagee does not have property of the residential property in this sort of mortgage i.e. it gets just professional possession which might bring about absolute possession in situation of default by the mortgagee. With the modification in the stipulation, great focus is put on instilling the arrangement of repurchase in the original sale deed itself as opposed to the transaction being executed via two records. Where they are in different records the debtor then the nature of purchase would not be a home loan by conditional sale also if they are implemented concurrently.

- Interest-only fundings can be difficult to get due to the fact that they're riskier to financial institutions.

- These payments are spread over the length of a term, which varies from 15 to thirty years, normally.

- When the debtor home loan a property to one person and also home mortgages the exact same home to an additional person in order to safeguard one more loan, the bank loan is labelled as Puisne Home loan.

- And also it is essential to recognize what the kinds of home mortgages are and what the actual definition is.

Your residence or home might be repossessed if you do not maintain payments on your mortgage. The extra safety of this sort of deal suggests that rate of interest have a tendency to be somewhat greater than the very best marked down or tracker prices. There will also typically be an Early Repayment Cost if you pay off the home loan in full as well as remortgage to another offer. Thus, this kind of mortgage does not require any writing, and also being a dental deal is not influenced by the Law of Enrollment. In the case of English Mortgage, the debtor moves the ownership of the mortgaged building definitely to the mortgagee as protection.

Fha Home Mortgage

An equitable mortgage is affected by the shipment of documents of title to the residential property to the mortgagee. In a legal home mortgage, the legal title to the property is transferred for the mortgagee by an act. To appropriate such rents or profits; in lieu of passion, or in repayment of the mortgage cash, or partially in lieu of rate of interest and also partly instead of the home loan cash. Nonetheless, the mortgagee can not directly sell the property, and also the sale has to be via the court's treatment. This may affect which items we review and cover, but it in no chance impacts our recommendations or advice, which are grounded in hundreds of hrs of research study. Our partners can not pay us to assure desirable reviews of their product and services.

A lot of lending institutions do not provide for a subsequent home loan backed by the very same property. A 5/1 variable-rate mortgage is an ARM that preserves a fixed interest rate for the first five years, after that adjusts every year afterwards. As their name suggests, reverse home mortgages are a very different economic product. They are designed for homeowners 62 or older that intend to convert timeshare cancellations component of the equity in their residences into cash. ARMs typically have limitations, or caps, on just how much the rate of interest can rise each time it readjusts as well as in overall over the life of the funding. Stay in the know with our latest residence tales, mortgage prices wesley financial group reviews as well as refinance tips.

Finance Against Home Early Repayment

We do not exiting timeshare contract include the universe of business or financial offers that may be available to you. We are an independent, advertising-supported comparison solution. Free Financial Modeling Guide A Total Guide to Financial Modeling This source is created to be the very best complimentary overview to financial modeling! Learn economic modeling as well as evaluation in Excel the easy means, with step-by-step training. Gain the self-confidence you need to go up the ladder in a high powered corporate financing profession path. This article/post consists of referrals to service or products from one or more of our marketers or partners.

This can give important comfort, as your month-to-month mortgage payments will coincide each month, no matter whether rate of interest boost on the larger market. Balloon home loans last for a much shorter term as well as function a whole lot like an fixed-rate mortgage. The month-to-month repayments are lower because of a big balloon repayment at the end of the finance.